Contents

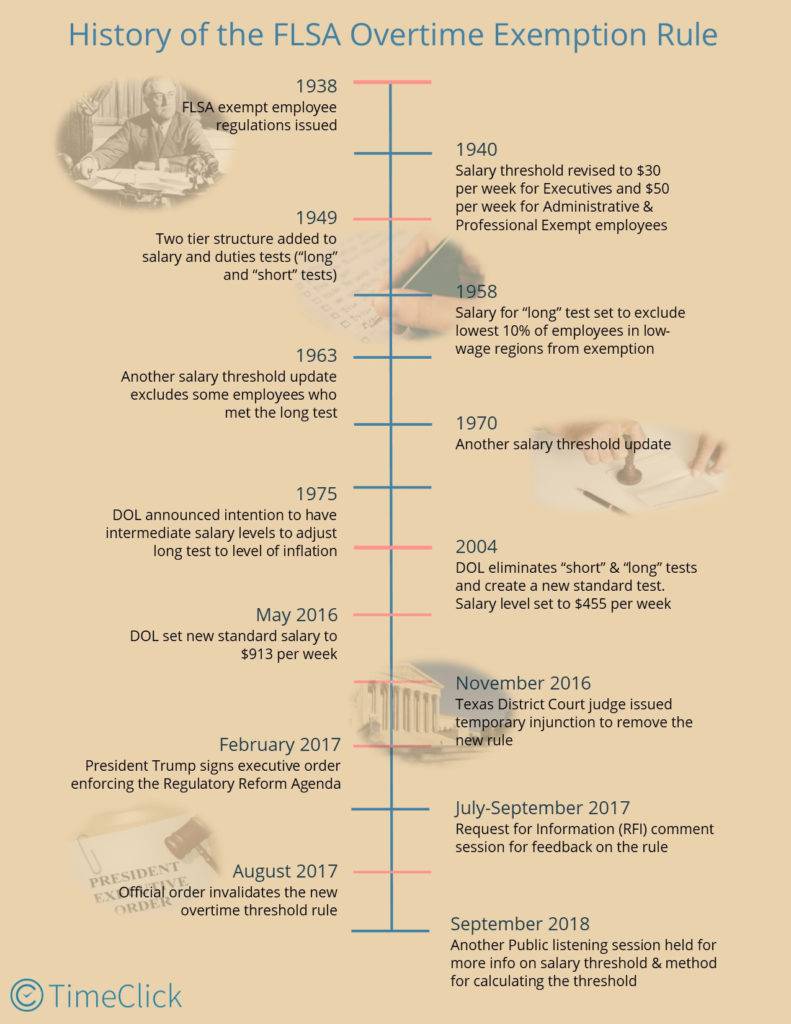

The white-collar exemption. A topic that has come up multiple times throughout its history. It’s ever a law with large repercussions for both employers and employees. Changes in the law for overtime exempt employees are nothing new. Below is a brief history of the Fair Labor Standards Act (FLSA) with its overtime exemption rulings.

Brief History of the FLSA

Minimum Wage and Overtime Laws

Near the end of the Great Depression, in 1938, President Franklin D. Roosevelt signed the Fair Labor Standards Act (FLSA) into law to provide workers with employment protections. The Act set a new federal minimum wage, now $7.25/hr. It required that any hours worked over 40 hours in a workweek be considered “overtime work” and paid at one-and-a-half times the employee’s normal pay rate. Not all employees were made eligible for overtime benefits, and those not were labeled “exempt”. As outlined in the FLSA these exempt employees had to be “bona fide” executive, administrative, or professional level employees.

Changes were made in 1940 to the salary amount of employees who fell under the executive, administrative, and professional exemption duties. Employees with executive duties needed to make at least a $30 weekly salary while administrative and professional required at least $50 in salary per week.

Long and Short Tests

Nine years later the “long” and “short” tests were implemented. The long test consisted of a list of rigorous duties and a lower salary threshold to qualify for an exemption. If an employee performed the duties in the long test list and spent less than 20% of their time on non-exempt work, they were considered exempt employees even if they made a lower salary.

The short test was less picky about how much time an employee spent on non-exempt work. However, they had to meet a higher salary level to be exempt. For about 55 years no changes were made to the duties test. However, the salary threshold was adjusted on occasion to keep up with the rate of inflation.

The Single Standard

The most drastic changes to the regulations were made in 2004 under the Bush Administration. The long and short tests were replaced by a single standard for employees performing executive, administrative, and professional exempt duties. The salary threshold was set at a standard $23,660 minimum annual salary. The rule sat unchanged for the next 12 years until the Obama Administration attempted to change it again.

In 2016, the salary threshold for exempt employees was proposed to more than double from $23,660 to $47,476 annually. This salary threshold was intended to exclude the salaried workers in the lower 40th percentile of the lowest wage census region or the workers earning lower salaries than 60% of the workforce in the poorest area of the country, from overtime exemption. The increase was planned to take place over the course of three years after the final rule during the Obama administration.

Just before the ruling was to take effect, a preliminary injunction* was issued by a Texas district court judge in November 2016. It was after 21 states and over 55 business groups filed cases in the Texas federal district court in an attempt to stop the rule. That same month Donald Trump was elected as the President of the US.

*An order by a court to restrain a party from going ahead with a course of action.

The Regulatory Reform Agenda

Shortly after his inauguration in 2017, President Donald Trump issued an executive order for the Regulatory Reform Agenda. This gave federal agencies the task of identifying any ruling or regulation that potentially inhibited job creation, retention, or benefits for both employees and employers. The overtime rule on hold from 2016 was identified as a potential inhibition to job growth and business benefit. A permanent injunction shot down the ruling by August 31, 2017. In September of 2017, public comment sessions were held to hear what employers thought of the rule, its effect on their businesses and what the method should be used for determining salary threshold.

In September 2018, the DOL released another Request for Information. This was to get public feedback for a new rule to increase the salary threshold. Comments sessions were held in five states with 270,000 participating businesses. The DOL planned to propose the new overtime rule in October 2018. However, it pushed the expected proposal date to early 2019.

What Now?

The new proposal for the overtime salary threshold is expected in March of 2019. The changes to the salary threshold are potentially less extreme than the original 2016 bill of increasing the salary level to $47,476. Instead, it may be closer to $30,000-$35,000. Many employers believe that a salary threshold jump much higher than this would be a shock to the system. It would result in doing more harm than good for employees. But, some increase to the salary threshold is overdue as the current threshold is near the national poverty line for three persons in a household.

There is general agreement from the public comment sessions that the salary threshold should be matched more closely to the current living wage and be adjusted for inflation. However, it is still not entirely decided whether there should be regular updates to the threshold. How large each update would be, how high the salary threshold will be, and if it will vary based on region or employer size is also tentative.

If all goes as planned, we can expect the new FLSA overtime rule to go into effect sometime in 2020.

Many employers can anticipate a change in some of their employees’ exempt status if employee salaries are not raised for those employees who may be currently making a salary of $30,000 or less. If businesses are not in the position to raise all currently exempt employee salaries, this would be a good time to begin tracking employee time. You can ensure preparedness by managing and tracking overtime hours accurately.

References:

https://www.gpo.gov/fdsys/pkg/FR-2017-07-26/pdf/2017-15666.pdf#page=1

https://www.everycrsreport.com/reports/R45007.html

https://www.bizjournals.com/columbus/news/2017/10/01/obama-s-overtime-rule-struck-down-trump-s.html

https://www.businessmanagementdaily.com/51409/dol-expect-new-overtime-pay-rule-2019